High Court judge Justice Mugure Thande is today expected to rule on whether the Kenya Kwanza administration should proceed with the implementation of Finance Act 2023 after it was suspended last week via a court order following a suit filed by Busia Senator Okiya Omtatah.

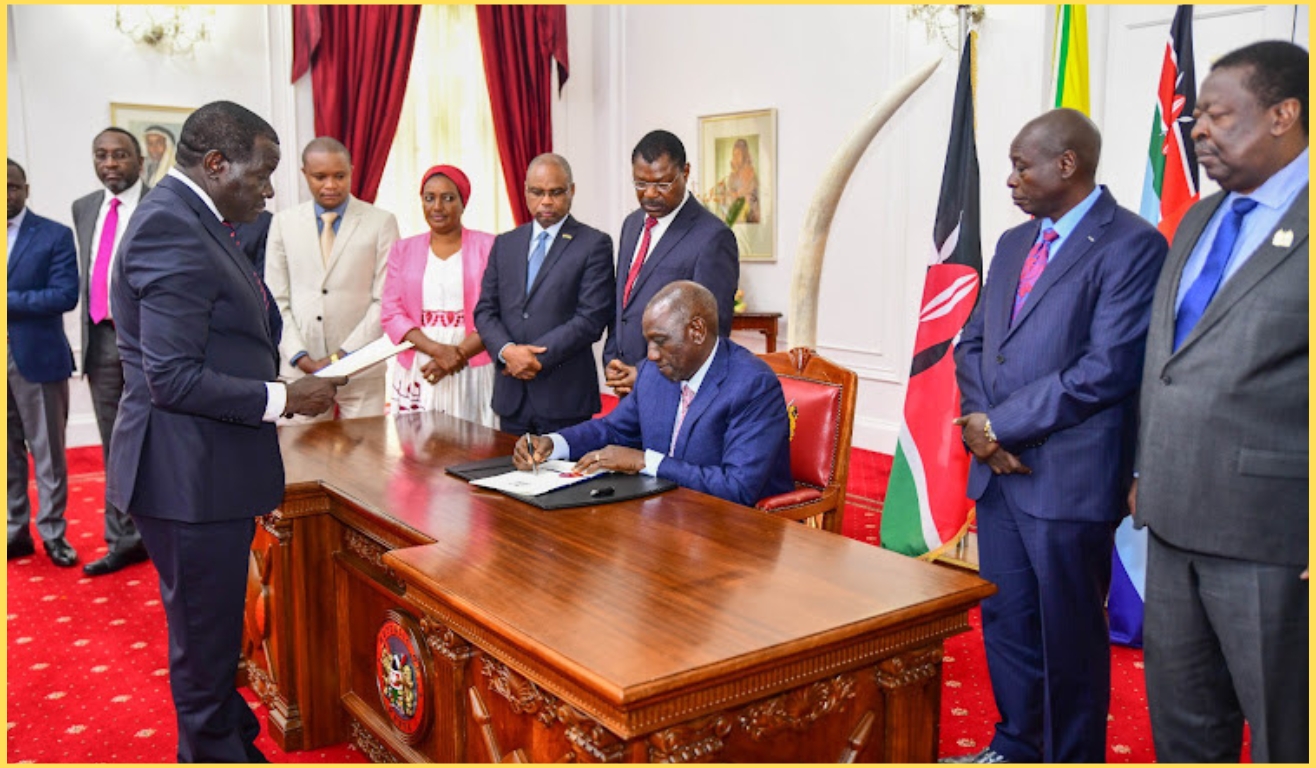

The High Court last Friday extended conservatory orders suspending implementation of the Finance Act 2023 for a further five days after President Ruto assented the Finance Bill 2023 into law on Monday, June 26, 2023.

Senator Omtatah challenged the implementation of the Finance Act on grounds that the Senate was not involved in the passing of the controversial law.

However, this afternoon’s Court ruling is critical for the new administration given President Ruto’s Bottom Up Economic Transformation Agenda (BETA) and its five pillars depend on the implementation of the Finance Act 2023.

The Head of State has reiterated the Finance Act is people centric and meant to improve the country’s economy. So, what roles does the new tax rules play in the development plans of the Kenya Kwanza Government?

The Finance Act has made several significant changes and adjustments to previous tax rates, as well as the introduction of acts that will greatly improve the lives of Kenyans in the long run.

First key change is the Fuel Levy set to increase from 8% to 16%. The levy is predicted to generate about 61 Billion in revenue. This will provide funding for the much needed development programs such the Tea and Coffee reforms currently spearheaded by the Deputy President’s office.

The Kenya Kwanza administration argues, an increase in fuel levy will be a key source of its revenue to help in funding government plans under BETA.

LPG exemptions on the Finance Act will also see Kenyans enjoy lower prices for cooking gas to help ease the burden on households and also promote clean energy in line with President Ruto’s climate change reforms.

The second most discussed levy of the new laws is the 3% Housing Levy deductions for the government’s Affordable Housing Program.

The Housing Levy is predicted to generate an additional 57 Billion, according the President William Ruto. This will be a significant increase in revenue collected towards the 2023/24 budget. It aims at growing the mortgage finance markets and unlocking land for development across the country.

Exemptions such as the levies on fertilizers and inputs of raw material imported or locally purchased is a welcome move to farmers. The exemptions intends to lower prices of fertilizers for farmers.

In the recent Tea Summit in Kericho, cost of production was one of the most mentioned challenge facing tea farmers in Kenya. With lower prices of fertilizers, farmers will be assured of lower prices and ultimately, lower production costs while enjoying higher production output.

The Finance Act also proposed the reduction of income tax rate for non-resident persons from 37.5% to 30%. This amendment is set to encourage more non-residents to conduct business in the country as well as boost foreign direct investment.

For landlords a lowered rate of 7.5% from the previous 10% Rental Income Rate is a boon. The Kenya Kwanza Administration is using this provision to partially solve the current housing crisis as landlords can now charge lower rent while also maintaining a considerable income.

Another key change is the introduction of the Post-Retirement Medical Fund, a program that is aimed at improving healthcare for the older citizens. This fund will ease the burden for retirees’ families while ensuring that older Kenyans have access to affordable healthcare.

Other changes relating to universal healthcare include tax exemption on goods meant for construction and equipping specialized hospitals, diagnostic tools, inputs for pharmaceutical manufacturers and their products, ophthalmic instruments, appliances and apparatuses. This Kenya Kwanza administration believes will lower the cost of healthcare significantly.

In efforts to help cushion Kenyans from the current high cost of living, the Finance Act 2023 has allowed for zero rating of maize, wheat and cassava.

For Kenya Kwanza government, today’s ruling is critical because the Act seeks to address the challenges facing ordinary Kenyans because will help stimulate the economy.

The new tax laws, President Ruto repeatedly says, is key to self-reliance. Kenya’s external debts are a hindrance to development and Kenya Kwanza believes the act seeks to address the problem. Revenue collected will increase government revenue to pay salaries, deploy more teachers to public schools, hire more health workers, develop infrastructure and much more development projects in the country.

On Agricultural reforms, the Finance Act has listed critical tax exemptions to lower the cost of production. tax exemptions of transportation of sugarcane and the fertilizer subsidies. In addition to the above, the Finance Act 2023 lowers excise duty on telephone and data services from 20% to 15% in efforts to lower the prices of calls and mobile internet.