Minority Leader Opiyo Wanday has raised an alarm that the country’s economic situation could worsen in the coming days after the Kenya Revenue Authority failed to meet its revenue collection targets which are relied upon to finance several government sectors.

In the financial year ending in June this year, the taxman had a revenue target of Sh 2.1 trillion but according to the opposition they have managed to collect Sh 1.2 trillion facing a deficit of Sh 900 Billion.

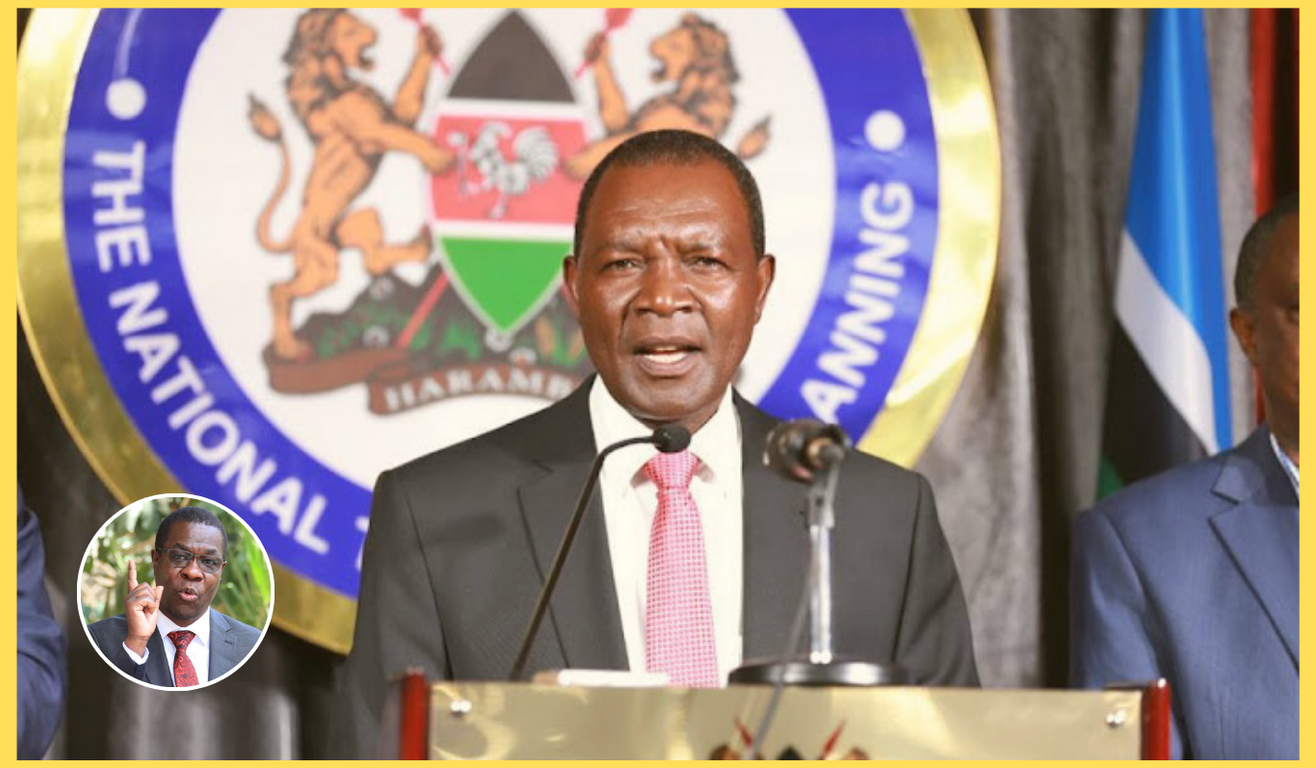

“If you say you have met your revenue targets, then where is the money? Why haven’t you paid salaries to the workers?”Wandayi asked in a statement at Parliament Buildings.

He dismissed the declaration by the revenue collector body that they have met their targets and they anticipate a surplus in revenue collection by June,this year.

“And if it’s true that KRA has collected the money and remitted, then treasury must tell us where the money is? Why is it that just a few months after the regime of Kenya Kwanza, things are going south,” the Minority leader said.

President William Ruto’s Economic Advisor Dr. David Ndii has blamed the current cash crunch on matured Chinese loans explaining that the government prioritized debt repayment first.

The Opposition Coalition has however rubbished the explanation saying it’s a mere excuse calling on the government to offer Kenyans solutions instead of offering conflicting statements.

“Ndii has blamed the problem on matured Chinese loans. How Chinese loans stopped KRA from meeting its revenue targets, only Ndii knows,” Wandayi stated.

On his Twitter account, Ndii alluded that multiple loans are maturing in their billions, yet revenue is not growing in tandem.

He attributed the tax target misses to businesses not reporting profit growth, thus shrinking tax growth.

“Debt service is consuming 60 percent plus of revenue. Liquidity crunches come with the territory,” he tweeted.

This comes even as the government admitted to being broke as the state had yet to pay public servants their March salaries.

The devolved units are also yet to receive their equitable share for the months of January, February, and March due to the cash crunch.

As of March 2023, the National Treasury had released Sh 141B out of Sh 370B for the financial year 2022-2023.