For a burdened Kenyan, getting a tax exemption can be a boon. Governments create tax exemptions to benefit taxpayers, businesses, or other entities in special situations.

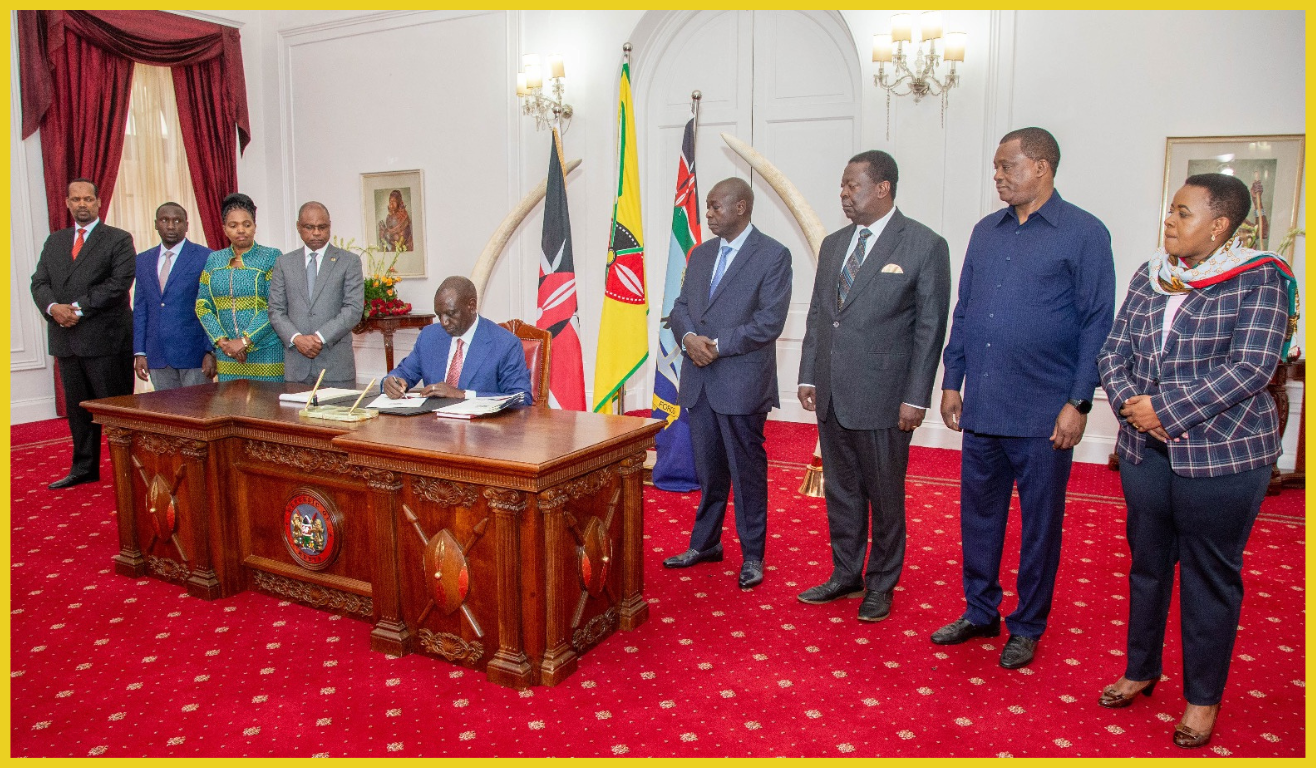

The Finance Act 2023 will be taking full effect this July, with various changes, either increases or decreases and tax exemptions.

Outside the hullaballoo and now, a High Court order blocking the Act’s implementation, Kenyans should expect a number of new lower tax rates and exemptions starting starting 1st July 2023.

LPG Exemption

Contrary to the 16% Fuel Levy, Liquid Petroleum Gas (LPGs) is tax exempted, making it affordable in most Kenya homes. Prices of cooking gas are expected to lower from tomorrow (1st July) with as much as Ksh430 for the 13kg refillable cylinder. Households now will be free of the “gas imeisha” message that sends a shiver down the spine.

Affordable LPG will phase out environmentally unfriendly fuels like as charcoal and firewood. In line to President’s Climate change affirmative action call in Paris recently, this is quite welcome news.

Rental Income Rates

For landlords and their tenants, the drop of rental income tax from 10% to 7.5% is a win. Millions of Kenyans live in urban centers and implementation of the Finance Act 2023 will see rental houses become be more affordable. houses will be more affordable as well as increase income for the landlords. This is also aimed at timely remittance of the rental income tax by the landlords

Zero-rating of Staple Food

One year after Russia’s invasion of Ukraine upended agricultural commodity markets, food prices remain elevated. With two of the world’s largest exporters of wheat and other crucial crops entering in their second year of war, many vulnerable countries, including Kenya still face heightened food insecurity.

Kenyans rely heavily on maize and wheat as a staple food and the Finance Act 2023 zero rates these food items. The burden of high cost of living brought about by the current high prices of food items will significantly be lowered.

Reduced Excise Duty on Mobile Data and Airtime

One of the pillars of President Ruto’s development plans is the creation of digital highway. To improve connectivity to all Kenyans of all walks. The reduction of excise duty on telephone calls and mobile data from 20% to 15% is an alignment to this goal. The new rates will see Kenyans pay less to access the internet on their phones while making communications in the form of telephone calls significantly lowered.

Exemption of Fertilizers Manufacturers

The Finance Act re-classifies all inputs and raw materials supplied to manufacturers of agricultural pest control products, agricultural pest products and fertilisers containing either two of nitrogen, phosphorus or potassium from zero-rated to exempt VAT supplies.

Lower prices on fertilizers is meant to improve food production as strategy to make the country food secure.