Barely two months after being accused of charging exorbitant rates in its mobile banking system, Co-operative Bank is back again in the spotlight, this time being accused of illegally wiping off over Sh. 1.5 million shillings from the account of one of its diseased customers.

After the passing on of her father on 20th June 2005, Diana Gachanja and her family were aware that there was Ksh 1,502,132.85 in the deceased bank account as it was the payment of his gratuity since he had been working for the Kenya Bureau of Standards.

As a result, the diseased wife, also Diana’s mother Priscilla Njeri Mwangi (then she was alive) embarked on processing the required letters of administration for her to be able to administer the estate of her late husband, as is required by law.

However, on 13th Jan 2006, she got a bank statement printed from the bank, much to her dismay, that over 1.5 million shillings had been withdrawn from her husband’s bank account.

”Unfortunately, she was not in good health at that particular time, to be able to lodge the complaint immediately, and as a family, we first sought for her treatment so that we can follow up on the money issue later.

As fate would have it, she also passed away on May 27th 2006 leaving behind I-Diana Wangechi Gachanja as the First born of her children with the responsibility of substituting her in managing the estate of our late father- Ng’ang’a Gachanja,” Diana says.

However, as soon as she started to follow up on the matter; Diana found out their file case in Thika went “missing” and she tried in vain to engage several lawyers who took her round in circles considering the file “couldn’t be found” hence it was technically impossible for her to get the Letters of Grant so as to be able to administer the estate effectively.

”This went on for several years until November 2012 when I engaged the office of the Ombudsman who wrote to the Executive officer in Thika to produce the file,” she continues.

Eventually, the file was produced in July 2013 but it became a huge task to get a reliable lawyer who would process her letters of grant. It was until 2021 that she engaged Arnold Otundo and Associates who processed the Letters of Grant for her.

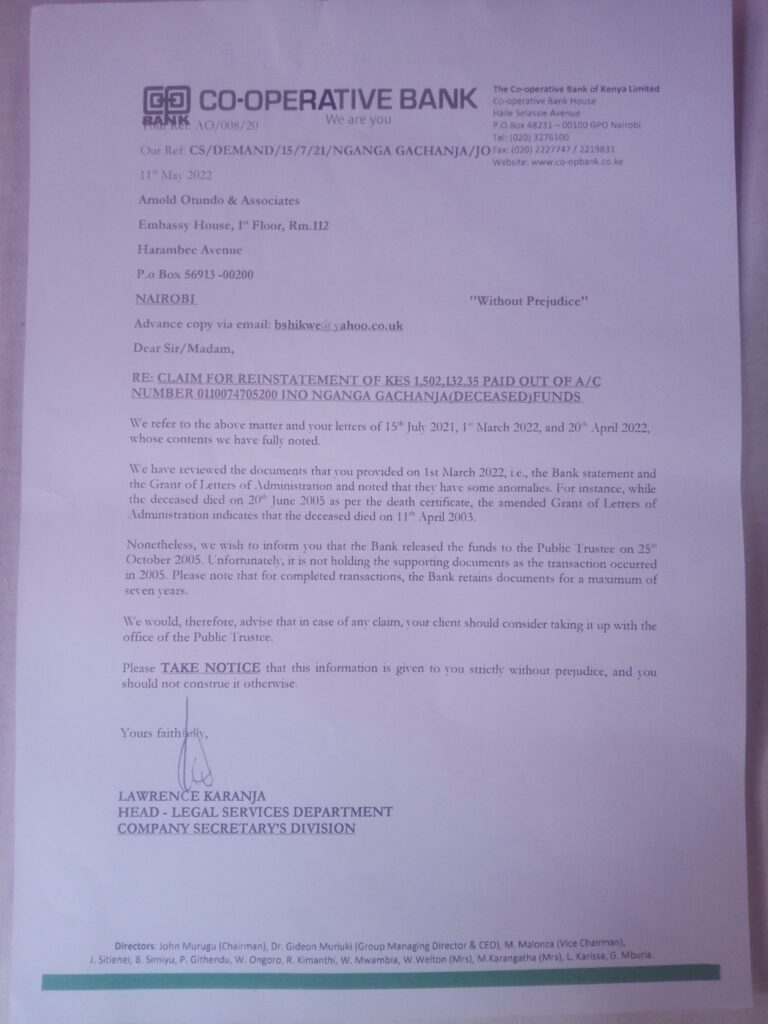

”As the letters were being processed, my lawyer sent the first letter to Cooperative Bank seeking reinstatement of the illegally withdrawn funds on 15th July 2021, they ignored as there was no response, we sent another second letter on 1st March 2022, that too was ignored, then we wrote a third letter on 20th April 2022 whereby we attached the bank statement and letters of grant that’s when we got a response from the bank,” Ms. Diana notes.

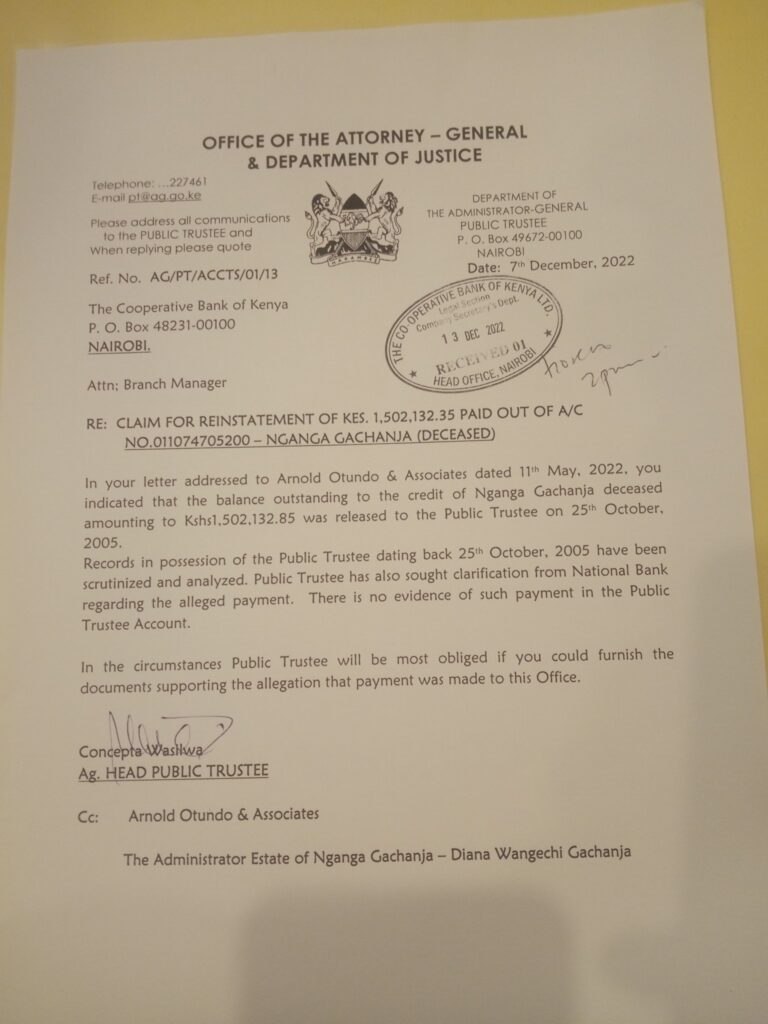

In their response, Cooperative Bank acknowledged that they indeed had the funds in their custody but they transferred the money to Public trustee on 25th October 2005, and they don’t have supporting documents to back up their claim.

Undeterred, she then wrote a letter to the Public trustee on 18th May 2022 to seek clarification but did not get a response immediately, prompting her to personally visit their offices where she was told after a few days that there are no such records in the bank’s custody.

”When I realized I am not getting forthcoming answers, I resulted to alert Cooperative Bank via their Twitter handle on 23rd October 2022 that the Public trustee are saying they don’t have the funds. They immediately got in touch with me at 3:32 am through a phone call made by Gedion to me. He asked me to explain my case once more and I did. He promised that they’re willing to sort out the matter and on Monday morning I should receive a phone on the way forward.”

In the afternoon of 25th October 2022, Diana would receive another phone call, again from Cooperative Bank, and the person on the other end explained that they were sure they sent the money to Public Trustee.

She proceeded to ask questions such as who gave the bank the authority to send the money there but the response she got was that they (Co-operative Bank) do not have to get authorization as a bank and they can act as they deem necessary.

”I then asked a second question, what is the time frame given by law to transfer unclaimed money? The lady told me seven years. Hence I asked her who informed the bank that my father was deceased within four months of his demise,” Diana says.

The bank failed to respond and maintained that she should follow up with the Public Trustee.

Eventually, after following up with Public Trustee, she was issued a letter on 7th December 2022 confirming that the funds are not within their custody.

”On 13th December I personally went to drop a copy of the letter to Cooperative Bank. I was then referred to Florence Njuguna who’s based in the legal department. I showed her the letter and she received it. When I asked what next she told me that I might not like their response as a bank and I am free to seek recourse,” she says.

After they received the letter, Diana and her family have not heard from Cooperative Bank again yet her late father’s funds, amounting to Ksh 1,502,132.85 are still missing.