President William Ruto said every Kenyan above 18 years should be issued with the Kenya Revenue Authority’s (KRA’s) pin, qualifying them as taxpayers.

Expansion of the tax base is part of the President’s administration’s target to raise Sh3 trillion by the end of the financial year ending June 30th, 2023.

“Every Kenyan with an ID should have a PIN number. Technology and a considerate, fair, and professional mobilisation will do the job quite well,” Ruto said during this year’s KRA’s Tax Day.”

To achieve this, the President challenged KRA to follow on Safaricom’s M-Pesa success.

“There are only 7 million people with KRA pin numbers. At the same time, in the same economy, Safaricom’s MPESA has 30 million registered customers, transacting billions daily.”

“The fact that this opportunity remains unclear to KRA demonstrates why radical changes are necessary. Safaricom, a telco, has registered more people than KRA, a powerful state organisation. It is very clear that the magic lies in technology and strategy, not power and resources,” he said.

Cumulative tax receipts in the first two months of the 2022/23 fiscal year stood at Sh280.2 billion compared to Sh247.8 billion in the previous fiscal year.

KRA had projected to collect a total of Sh2.072 trillion by the end of the fiscal year ending June 30, 2023.

“The consequences are painful to contemplate. Our GDP has risen to Sh12 trillion, yet KRA only raised about 14 percent of it in revenues last year. In the past, KRA was able to raise 18 percent of GDP.”

“If we collect the same target today then would have raised an extra Sh400 billion. I expect KRA to raise Sh3 trillion by the end of the next financial year and to double the current collection in five years,” he added.

Listening to that kind of talk from your president makes you realize the depth of a nightmare Kenyans are in for. That is a guy who knows absolutely nothing about the Kenyan tax system. I don’t blame him. That is what happens when you leave college and never go to work anywhere but get wrapped up in politics with Moi who gives you land and unlimited access to taxpayer cash in Kenya.

If Ruto ever went to work like we all did from college he would know a few things about how the taxation system works because he would have been paying taxes himself.

Let me give Ruto a free advice.

Mr. President, Kenyans and indeed every country in the world does not tax its citizens based on their age. People are taxed based on what is called Taxable Income. That means if you make a certain amount of money you are obligated to pay taxes according to established tax rates in your country. That is how taxes are collected.

No country can demand that school kids and other young people who have cell phones pay taxes because they own cell phones. This kind of thinking makes insanity look normal. Kenyans are now getting first-hand direct lessons on how a clueless president looks like. It is scary for the country.

Yes, a lot of Kenyans have cell phones but that does not amount to anybody having taxable income. And Ruto probably knows this more than anybody else. Any one person can have ten cell phones. You cannot apply the same method in allocating tax PIN numbers for taxation.

Maybe that could apply to Ruto and his billionaire friends who have hundreds of companies that should be paying taxes every year. It doesn’t apply to them because paying taxes is a foreign language to them.

So William Ruto wants to collect Shs. 3 trillion in taxes every year to sustain the Kenyan economy. Good but he must start by designing structures for the Kenyan billionaires a good number of whom are his political friends to pay their taxes. And in that department, Ruto and his deputy Gachagua are telling them to just pay taxes when they feel like and if they don’t know Ruto will give them a pass.

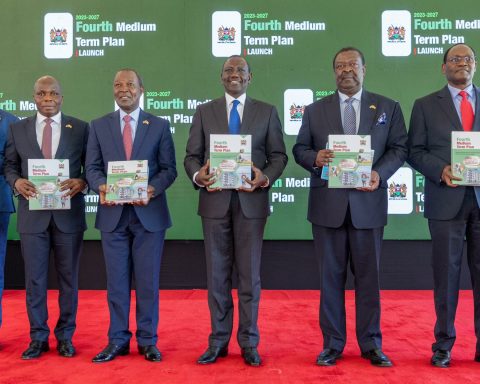

President Ruto just swore in his cabinet led by Musalia Mudavadi who told Kenyans his net worth is Shs. 4 billion and Mathika Lintuturi who told Kenyans he is worth Shs. 1.2 billion.

How much taxes do these rich Kenyans who won hundreds of rental homes all over Kenya and other profitable businesses pay in taxes for that income?

Ruto is not interested in that issue and the vetting system is fake and useless so they can have their money and lord it over tax-paying Kenyans pretending they will solve economic and social problems Kenyans face. That is not their job. Their job is to take everything they can from Kenyans and just laugh at the miserable poor Kenyans for doing nothing to solve their own problems.

“KRA should embrace consultations and engagement with the citizens whenever there are problems on payment of taxes instead of harassing them. Consultation and engagement should be modus operandi,” said Ruto.

Let’s start from the fact that Ruto’s instructions to the KRA betray how little if anything he understands about the Kenyan tax system. We know he was there to protect his non-tax-paying billionaire friends but can he at least try to learn something about the Kenyan tax system before he makes ignorant statements?

In Kenya, a huge source of tax revenue is from income taxes paid by every employed Kenyan working in public, private, or any other area of work. That income tax is paid through the Pay As You Earn (PAYE) system.

That means your income taxes are deducted at source by your employer and remitted directly to the government. It is relatively easy to manage because the companies remitting PAYE are registered with the government and have to submit those taxes. PAYE ranges from 10% for low income to 30% for those with relatively higher income.

This is the easiest tax for the Kenya government to collect and can’t harass the taxpayer on that because they have no contact with the employer in the collection and remittance of PAYE taxes. So Ruto is obviously not talking about these huge tax-paying groups in Kenya.

The real nightmare here is that at the end of every financial year the taxpayer has to file their own income tax return and then add to their employment income all the other income they had for the year in question. This is where the big rip-off in the tax system begins and it never ends.

Let’s say you are an MP or one of those billionaires in Ruto government you are supposed to include all other income. For the Ruto boys and girls who own billions they have hundreds of rental units, they own restaurants, they run dairy and beef firms they are required by law if and when they file their tax returns to add all those other incomes and then KRA will determine how much tax they owe and then set up a system of payment for that tax which is actually very generous to the billionaires because the ta system only requires to pay the amount by installment.

The truth is that rich Kenyans who make huge extra money part from their salaries also in millions from the Kenyan taxpayer never ever file any income tax return to add all the money they get from their businesses. That is bonus money for them and to hell with the KRA which incidentally never does anything to address that lost tax because they do not want to annoy big people who employ them.

This is what Ruto went to the KICC to remind them to keep doing. Ruto’s message to KRA and his rich buddies is that KRA should leave the rich alone because they are too busy making money for themselves to be concerned about paying taxes. That is a luxury the rich just cannot afford.

To complement his boss’s new ideas to help the super-rich avoid paying taxes the Deputy President Rigathi Gachagua took it a step further.

While citing the example of businessman Humphrey Kariuki’s distillery which was shut down by the agency, Gachagua called for dialogue with investors which he says is key to prosperity.

He described it as a foolish decision which he stated will never be allowed to happen again. Gachagua wants Kenyans to sing to rich Kenyans like him who do not pay taxes and give them hay and dance for them. Good luck with that for running a country.

“That factory was paying about Sh50 million in terms of tax every month. They sent DCI there, policemen, shut it down, arrested Humphrey Kariuki, a very enterprising Kenyan, a very honorable man, a man who was toiled through his life and built,” he stated.

“African Distillers factory owned by Humphrey Kariuki was closed & it was paying Ksh. 50M every month in terms of tax & for 3yrs we have lost Ksh.1.8B, money that we need in this country. That was a foolish decision and that will never happen in this administration.”

While encouraging Kenyans to diligently pay their taxes, he encouraged the tax agency to collect dues owed in a dignified manner.

“For a cow to produce milk, you have to give it hay. Europeans go a step further, they play country music to cows to produce milk. We have told them to look after taxpayers the way you look after a good dairy cow,” he stated.

“Let’s embrace consultations and engagement when dealing with issues pertaining to tax collection,” said Gachagua. In other words, if you are rich avoid paying taxes, and if needs be come talk to us. Wonderful plan to get tax money and build a revenue base in Kenya to help develop the country. These guys are going to bankrupt our country because they need money to do all the stuff they keep promising and they have no idea how to get that money. That is always a recipe for disaster.

In any event, somebody is actually putting Kenyan taxpayer money to good use. The just concluded vetting of the 24 cabinet secretary nominees by the appointments committee of the national assembly cost the taxpayer a whopping 10 million shillings in just 5 days.

Of the amount, about 5 million shillings were pocketed by committee members and support staff with each MP pocketing not less than 100,000 shillings as allowances. Senior political affairs reporter Chris Thairu reports, the 10 million shillings exclude allowances for support staff, bodyguards, drivers, late duty allowance, and refreshments. So was the exercise good for the money?

Who in Kenya wishes they could get a job where they get paid their salaries and then get paid extra money per second to actually do their job like these MPs sitting in committee meetings to do the job they are elected to do? And we wonder why our country is screwed up completely at least for now.

Adongo Ogony is a Human Rights Activist and a Writer who lives in Toronto, Canada