Concerns over the safety of customer funds at Equity Bank have resurfaced following a troubling case in which a client reportedly lost Ksh 180,000 through mobile banking fraud.

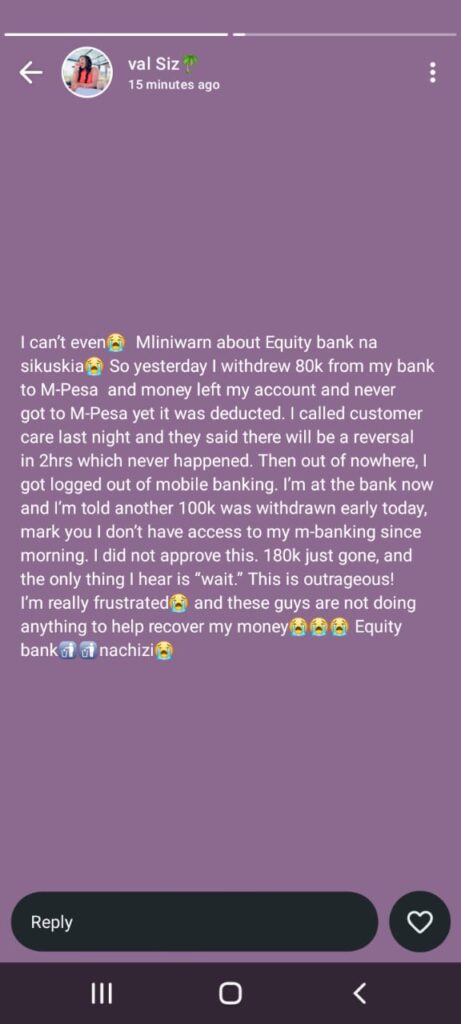

According to reports, the customer initiated a withdrawal of Ksh 80,000 from their Equity Bank account to M-Pesa. While the funds were deducted from the account, the money was never reflected in the M-Pesa wallet. Alarmed, the customer promptly contacted Equity’s customer care team, who assured them that the funds would be reversed within two hours. However, the reversal did not take place.

The situation worsened when the customer was suddenly locked out of Equity’s mobile banking platform. By the following morning, an additional Ksh 100,000 had been withdrawn from the same account without authorization, bringing the total loss to Ksh 180,000.

Despite reporting the issue directly to the bank, the affected customer claims they were only advised to “wait” as the matter was being investigated. This response left them feeling frustrated and helpless as their funds remained unrecovered.

The case has sparked renewed debate about the security of digital banking systems in Kenya. Equity Bank, one of the country’s largest financial institutions, has in recent years faced scrutiny over complaints of disappearing funds, delayed resolutions, and alleged loopholes in its mobile and online banking platforms.

With millions of Kenyans depending on mobile and digital banking for everyday transactions, financial experts warn that such incidents threaten consumer trust in the industry. They argue that banks must invest in stronger security systems, proactive fraud detection, and faster dispute resolution mechanisms to protect customers.

The incident now serves as a stark reminder of the risks associated with digital banking, with regulators and customers alike calling on Equity Bank to act swiftly to restore confidence and strengthen accountability in safeguarding depositor funds.